Odom Tower has the perfect location, will be LEED Gold-certified, and offers design and operations second to none. The developer has a strong track record, and the project is attractive. But what might this look like in terms of return on investment? Of course, if you are buying so that you can move your own company to its new home, the advantages are obvious – say goodbye to rental fees. For those SMEs and other businesses considering buying office space to work from, the savings can be immense in rental alone over 20 years, with a break-even around year 10 (depending on how financed). But if you’re looking for regular income, or the potential to sell later, Odom is an amazing opportunity.

Rental returns

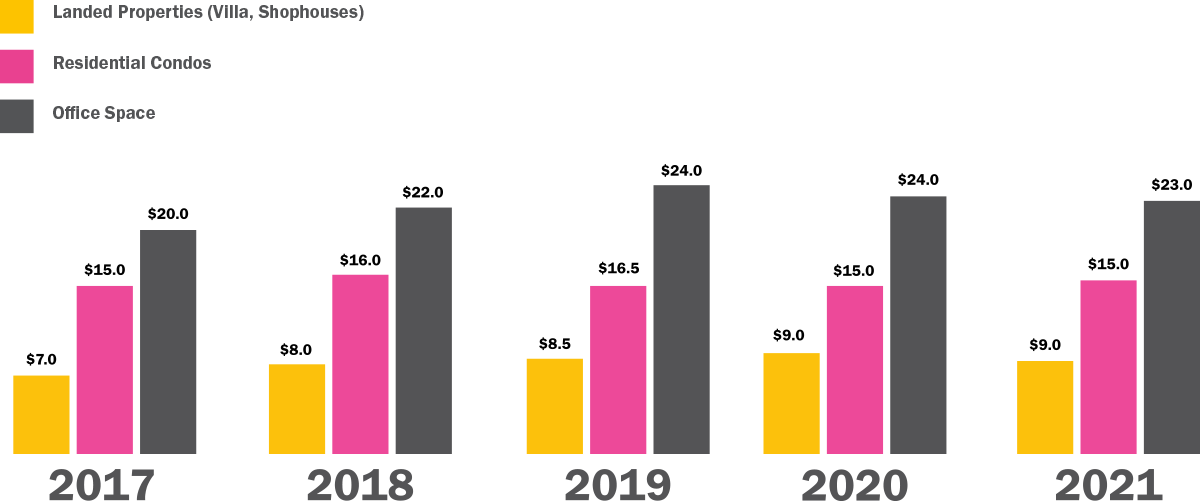

Over the past five years, office space has led the market in price per square meter in terms of rental prices. (See Fig. 4) On average, office space rents 40% higher than residential counterparts. This disparity may continue to increase with the large number of residential condominiums coming into the market. On the other hand, premium office space is still not at current capacity, and when Odom comes online, best-in-class office space with the best location will be in high demand.

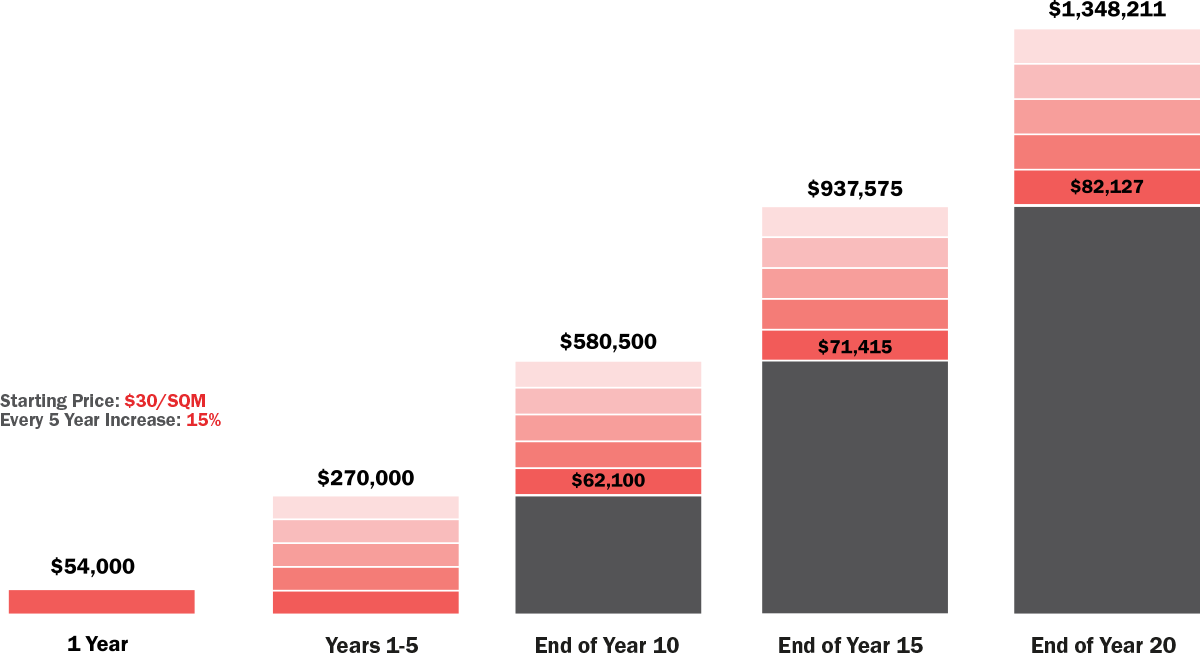

To illustrate, we projected what a 150 SQM office space might provide in terms of rental return over 25 years. Using current market trends, we assume that the starting rental price is $30/SQM, a reasonable start for when the project completes. We also assume a moderate rental increase every five years of 15 percent, in line (if not under)withrecent trends. For simplicity, we have priced this at $500,000 for 150 square meters ($3,333/sqm).

What we see is consistent, secure returns, grossing up to 1.3MIL over 25 years. But this kind of return will only continue for projects that stand up to the test of time and a changing city. Odom is one such project.

The next generation of business leaders and international firms will still look to Norodom as the heart of the city, the place where they want to leave their mark. Few projects will continue to be as prestigious, and not just 25 years from now, but also at year 30, 40 and long into the future.

Property value

For many investors, the quality and value of the asset itself is as important as the operational revenue might return. Whether planning to rent out the property for regular income, you still want the base value to increase. Office Condos, and Odom Tower, are solid investments.

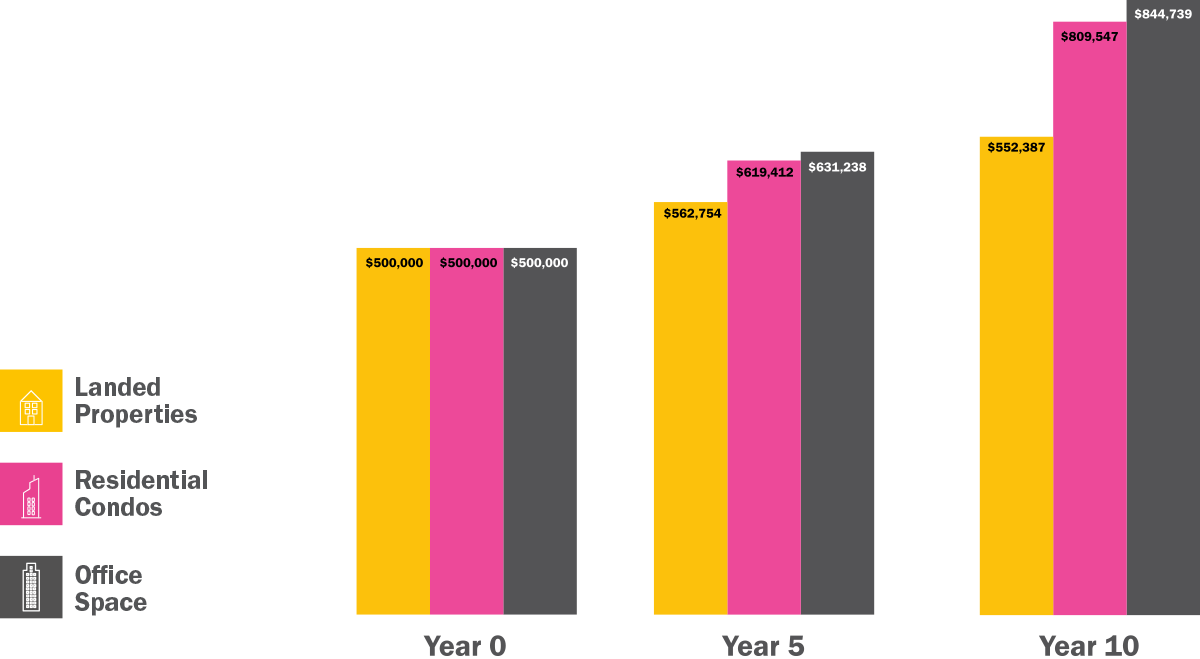

Looking at the past five years of real estate data, central district office space appreciates, on average, higher than residential condos or landed residential properties. (See Fig. 6) To look at how this might apply to an office space at Odom Tower, we asked, what would a $500K investment look like over time compared to other property types?

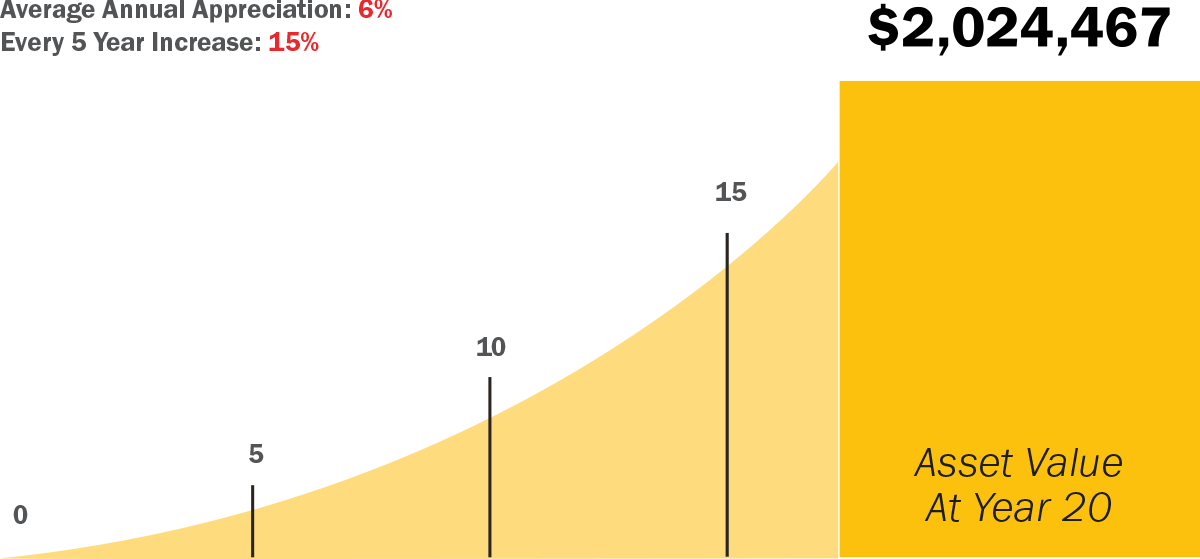

For this example, we look at the same $500,000 investment in Odom Tower, but this time to estimate the value of the property over time. We reviewed past commercial office space performance, and we are assuming an average of 6% property appreciation, using the same 25-year scale. At the end of year 25, the value could be over 2 million, and this excludes any rental income it might generate. This, of course, is dependent on the quality of the property, the location, and operations, but we hope Odom has already made the case for itself.

How might a $500,000 investment in a 150 SQM office return in rent?

Here’s how. Even with a modest 15% rental increase every five years, you’ll have a steady stream of income.

$500,000 Investment

Landed Property vs. Condo. vs. Office Space

Source: Pointer Real Estate, projection based on past 5 year performance. Investment is not a guarantee of return.

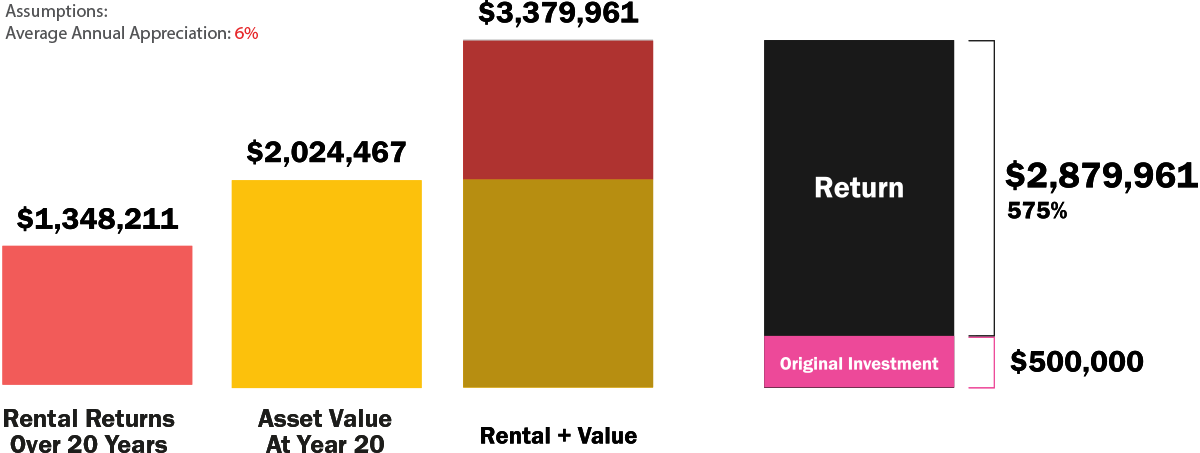

The full story: Rental Returns & Asset Appreciation

A worthwhile investment should provide both regular income, and the potential for a large cash-out when the time is right. We have shown you what rental income might look like, and provided a conservative example of how the asset might appreciate, but how does this look like when put together? Conservatively, this could be almost 3 million, a 575% return. (See Fig. 8)

How might a $500,000 investment in a 150 SQM office return Overall?

The answer? Odom Tower

A successful investor is diversified, hedging risk between different sectors and among different products. Likely you already have a substantial number of residential properties and land. But what is your commercial real estate exposure? With Cambodia’s historic GDP growth expected to continue catalyzing a new generation of entrepreneurs, where will they want to work?

A successful investor investigates all angles of a project. Where is it located? Is it (and will it continue to be) desirable for renters? Is the neighborhood established and will it maintain its character? Will the development add to the prestige of the area? Will it succeed?

Often projects tick a few of these boxes, rarely do they hit them all.